- Loans, Lenders, and Leverage

- Posts

- Oracle's $2.3B AI Playground, Goldman Sach's State Farm Double-Down, CIBC's Solar Power Party

Oracle's $2.3B AI Playground, Goldman Sach's State Farm Double-Down, CIBC's Solar Power Party

[5 Minutes Read] Plus C-PACE: Turning Office Discounts into Green Gold

TO CONTINUE TO SUPPORT OUR NEWSLETTER, WE APPRECIATE YOU CLICKING ON TODAY’S SPONSOR AND LEARNING HOW LAND.ID CAN HELP GROW YOUR BUSINESS

The Real Estate Professional’s Secret Weapon - Land id™

Discover extensive nationwide private parcel & ownership data

Create & share powerful, interactive maps of any property

Mobile Apps: Find property data on the go

Good Morning Everyone

JP Morgan's mammoth $2.3B bet on AI infrastructure transformed the lending landscape last week, as their Oracle-anchored data center financing challenges conventional credit metrics. This deal, alongside Fenton's $191M mixed-use play in Cary, reveals a fascinating shift: lenders are now pricing in "adaptability premiums" for properties with flexible space allocation, offering up to 150bps better terms than single-use assets (who knew being indecisive could be so profitable?). The real plot twist? Traditional office buildings like 1370 Broadway trading at 60% discounts aren't just distress signals - they're creating arbitrage opportunities for savvy investors combining C-PACE sustainability financing with creative recapitalizations, as seen in Oaktree's recent $24M LA office deal.

This week's top deals plus:

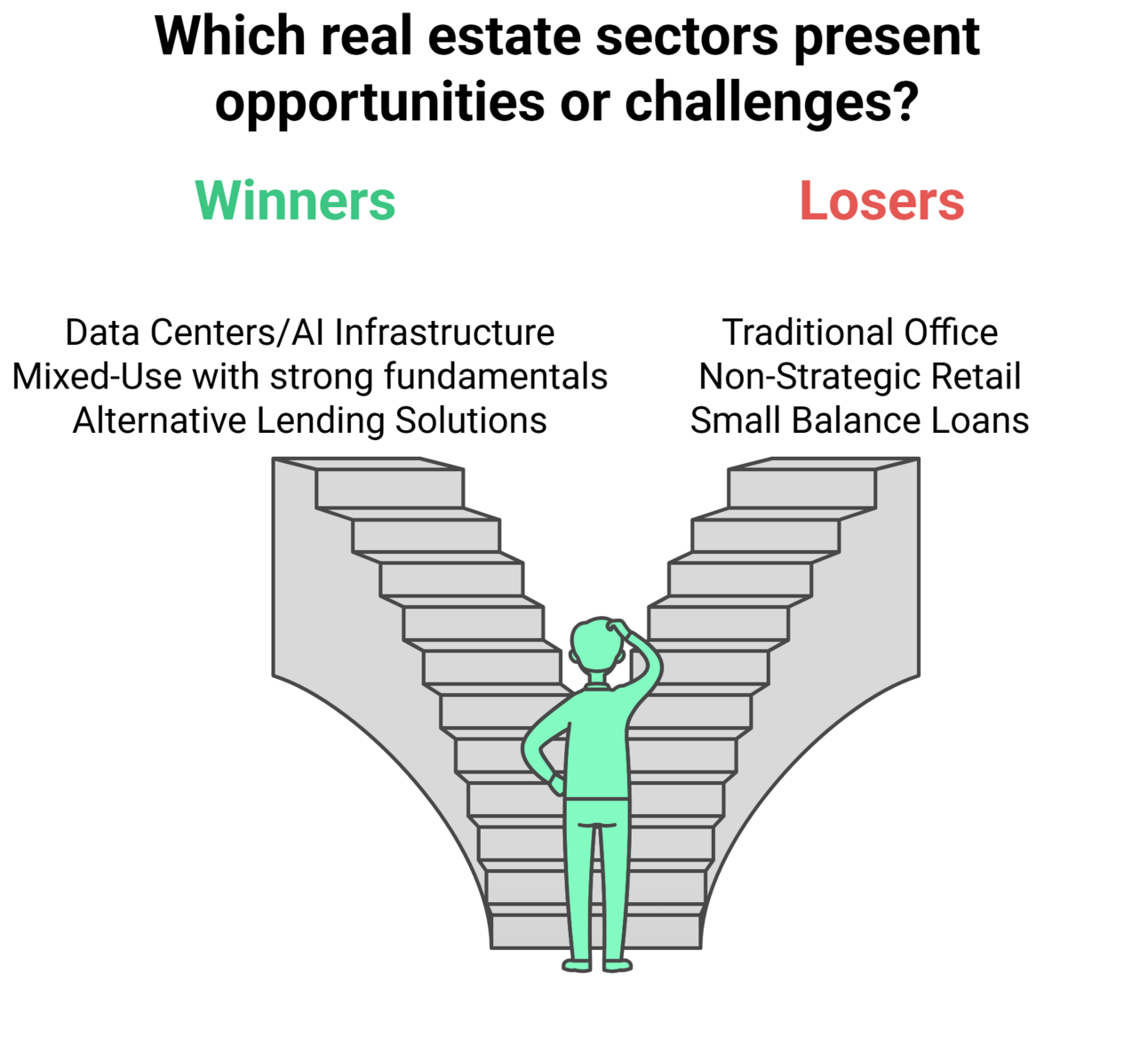

💚 Winners & Losers (Data Centers/Mixed-Use projects/C-PACE top the chart)

🎯 Tips For Borrowers (Life lenders, Mixed-Use “density hedge” strategy, AI)

🔄 Opportunities for Brokers, Lenders, Developers, Investors, and RE Agents

💎 New Loan Programs (SMBC Equipment Loan & Coinbase $100K Crypto Loan)

Let’s dive in.

🔄HELP SHARE OUR NEWSLETTER WITH YOUR FRIENDS AND NETWORK

I hope you find value in today’s newsletter if:

1) You want to know what Commercial Real Estate lenders are mainly financing

2) You want innovative insights/strategies to secure CRE debt financing.

3) You seek active Commercial Real Estate lenders to close your next deal.

Bridge Loan Guy

Top Loans of the Week

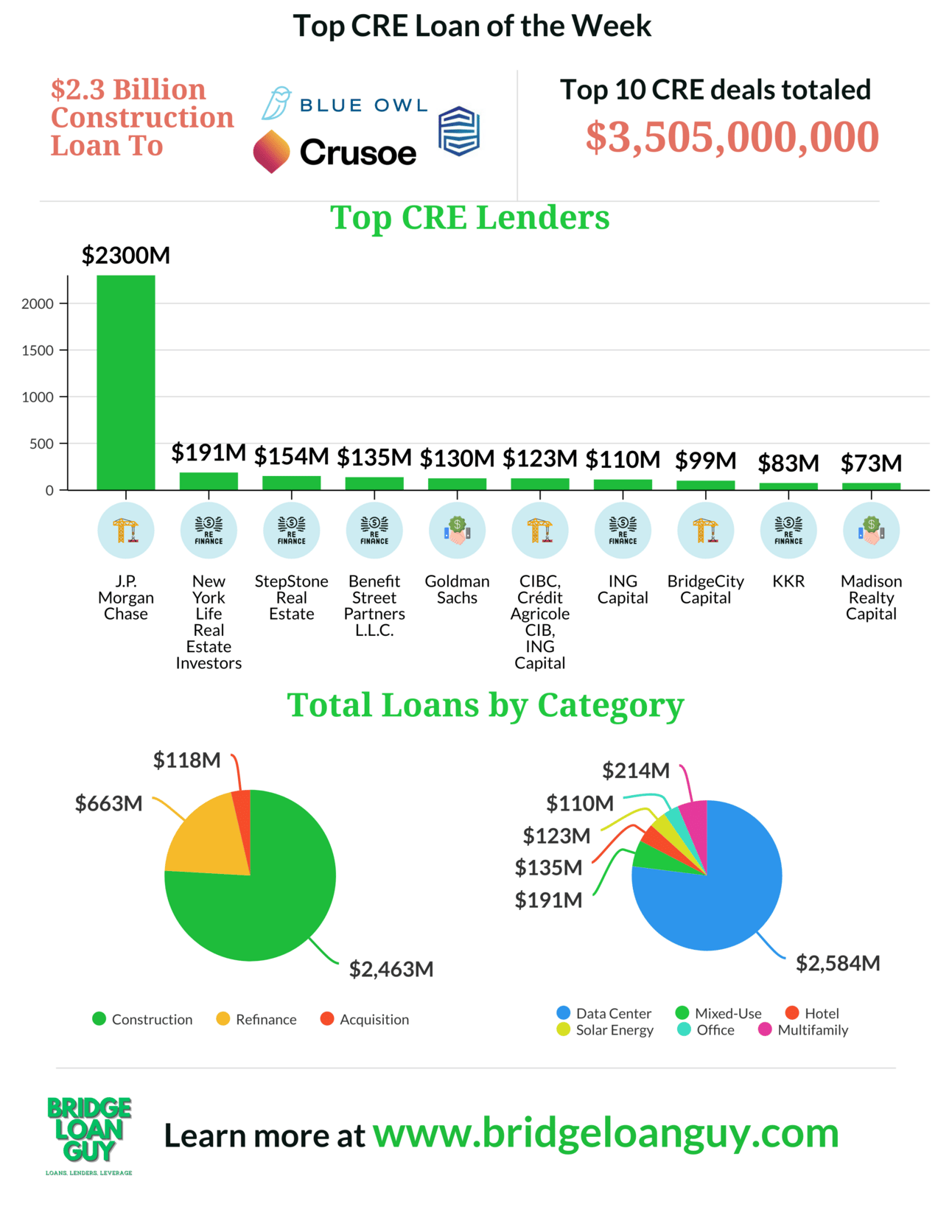

Top Commercial Real Estate Lenders

Construction Loans: J.P. Morgan Chase, CIBC, Crédit Agricole CIB, ING Capital, BridgeCity Capital

Acquisition Loans: Goldman Sachs, Madison Realty Capital, Fortress

Refinance/Bridge Loans: New York Life Real Estate Investors, KKR, StepStone Real Estate, Benefit Street Partners, ING Capital, MonticelloAM

C-PACE Loans: PACE Loan Group, Nuveen Green Capital

Largest single deal: $2.3 billion for a data center in Abilene, Texas

Number of states involved: 15

Sectors financed: Multifamily, Retail, Industrial, Data Centers, Senior Housing, Luxury Residential

Construction Loans

◾ JP Morgan Chase supplies $2.3B construction financing for 206MW build-to-suit data center in Abilene, Texas leased to Oracle Read

◾ BridgeCity Capital lends $83M for Hudson Valley townhouse condo project in Monroe, New York to Upscale Developers Read

◾ Treaty Oak Clean Energy secures $123M financing for Redfield Solar Project in Grant County, Arkansas through CIBC, Crédit Agricole CIB, and ING Americas Read

Acquisition Loans

◾ HMC Capital and StratCap secure a $130M acquisition loan for two State Farm-leased data centers in Texas and Kansas through Goldman Sachs Read

◾ Madison Realty Capital lends $58M to acquire Arium Lincoln Pointe apartments in Aventura, Florida, to Related Group and 13th Floor Investments Read

◾ Sentry Realty completes a $76M purchase of 1370 Broadway in New York City with a $49M loan from Fortress Investment Group Read

Refinance Loans

◾ New York Life Real Estate Investors provides a $191M senior mortgage loan for Fenton mixed-use development in Cary, North Carolina Read

◾ Benefit Street Partners closes a $135M senior and mezzanine loan package for the refinancing of The Empire Hotel in Manhattan, New York Read

◾ KKR provides a $73M refinance for Bell South Bay Apartments in Los Angeles, California Read

◾ BKM Capital Partners recapitalizes Pacific Business Center in Las Vegas, Nevada for $154M in partnership with StepStone Real Estate Read

◾ RXR undertakes a $180M recapitalization of a New York Office with Sagehall and secures a $110M loan from ING Capital Read

C-PACE Loans

Naftali Group secures $40M C-PACE financing from Nuveen Green Capital for JEM Private Residences in Downtown Miami, Florida Read

Oaktree Capital lands $24M C-PACE financing for Los Angeles office tower through PACE Loan Group Read

🏆 Winners

◾ Data Centers: JP Morgan's $2.3B Oracle-anchored construction loan and Goldman's $130M portfolio financing demonstrate a strong appetite for AI-driven data center development

◾ Mixed-Use with Strong Fundamentals: JLL's $191M financing for Fenton mixed-use in Cary, NC and BHI's $99M residential conversion loan highlight lender confidence in quality mixed-use projects

◾ Alternative Lending Solutions: C-PACE gaining traction with Oaktree securing $24M for LA office sustainability improvements and similar deals in hospitality sector

❌ Losers

◾ Traditional Office: Properties like 1370 Broadway trading at steep discounts ($75.5M vs $186M prior sale) reflect continued sector challenges

◾ Non-Strategic Retail: Basic retail centers seeing shorter terms and higher rates, as evidenced by Avatar Financial's high-rate bridge loans

◾ Small Balance Loans: Deals under $50M facing higher rates and stricter terms, demonstrated by regional bank lending patterns in secondary markets

📝 Current Tips For Borrowers

Stack multiple financing sources

Oracle's data center deal demonstrates how combining construction financing with specialized AI/tech infrastructure funding can maximize proceeds and improve terms

Target life company debt for stabilized assets

Insurance companies are actively lending on core properties at competitive spreads, offering 7-10-year fixed-rate terms below 6%

Front-load sponsor equity

Deals with 40%+ initial equity are seeing dramatic improvements in pricing, even in challenging sectors

AI infrastructure

The $2.3B JP Morgan data center deal signals AI infrastructure emerging as the new "credit tenant," potentially replacing triple-net retail as a defensive play in lending marketsC-PACE financing on ESG properties

The rise of C-PACE financing (exemplified by Oaktree's $24M office deal) shows lenders using sustainability metrics to gauge sponsor quality, with ESG-focused properties securing 75bps better pricingMixed-Use “density hedge” strategy

The $191M Fenton mixed-use financing reveals lenders' growing preference for "density hedge" projects - those with adaptable space allocation are receiving 100-150bps better terms than single-use developments

💡 Opportunities

Brokers

◾ Data Center Financing Boom

Targets: Data center developers/operators, AI infrastructure companies, and Green energy providers (many data centers require renewable power)

Referral Partners: Energy consultants and tech infrastructure advisors

◾ Multifamily Conversion Financing

Targets: Office building owners looking to convert, Multifamily developers, Architecture firms specializing in conversions

Referral Partners: Office leasing brokers and architectsLenders

◾ Data Center Development and Expansion

Why It Works: Build-to-suit data centers for major tech tenants represent significant lending opportunities as AI drives demand

Similar Target: Digital Realty Trust, Equinix

Referral Partners: Tech-focused brokers and energy/infrastructure consultants

◾ Senior Housing and Skilled Nursing Facilities

Why It Works: The aging population is driving demand for senior living and skilled nursing facilities. These assets offer stable cash flows and long-term growth potential, making them a solid bet for lenders.

Similar Target: Ventas, Welltower

Referral Partners: Healthcare-focused brokers and senior living consultantsDevelopers

◾ Data Center Momentum

Why It Works: AI-driven demand is creating massive opportunities in secondary markets, but tenant pre-leasing is crucial

For Smaller Players: Partner with edge computing providers for smaller (5-20MW) facilities in tier 2/3 markets

Referral Partners: Power companies, AI/tech startups, local economic development agencies

◾ Multifamily Value-Add in Growth Markets

Why It Works: Below-market rents offering immediate upside and waterfront/amenity-rich properties drawing institutional capital

For Smaller Players: Target 1980s/90s vintage properties in high-growth suburbs and focus on properties with deferred maintenance but good bones

Referral Partners: Property managers, local architects, and renovation contractorsInvestors

◾ Alternative Living Communities

Why It Works: Strong-performing retail near universities/medical centers and high-traffic corridors with stable anchor tenants

For Smaller Players: Target retail near growing medical campuses and focus on necessity-based retail in college towns

Referral Partners: University real estate departments, healthcare facility planners

◾ Senior Housing is a Demographic Goldmine

Why It Works: Baby Boomers are aging and not moving in with their kids. Senior housing, especially niche segments like memory care and assisted living, is booming

For Smaller Players: Focus on smaller, specialized senior housing projects in underserved areas and partner with healthcare providers to offer integrated care services

Referral Partners: Healthcare networks, senior care providers, local senior advocacy groups, and nonprofitsReal Estate Agents

◾ Suburban Multifamily is BoomingWhy It Works: The pandemic-fueled exodus to the suburbs isn’t over. But here’s the twist—it’s not just any suburb. It’s the ones with walkable downtowns, good schools, and access to urban amenities. Think “urban-lite.

Strategy: Focus on suburbs with strong job growth and infrastructure investments and build relationships with local employers to connect them with rental options for relocating employees

Referral Partners: Local employers, HR departments, and property management companies specializing in multifamily.

◾ The “Luxury Lite” Rental Market

Why It Works: High-income renters are trading McMansions for high-end apartments with killer amenities. But here’s the twist—they’re not just looking for penthouses. Think “luxury lite”: upscale finishes but in smaller, more affordable units.

Strategy: Focus on boutique luxury rentals in up-and-coming neighborhoods and offer virtual tours and personalized marketing to attract high-income renters.

Referral Partners: High-end real estate brokers (Douglas Elliman, Sotheby’s), and luxury retail and hospitality brands (Equinox, boutique coffee shops).

New Loan Programs/Lenders

◾ SMBC launches a semiconductor equipment financing program for Kioxia in Japan Read

◾ Coinbase introduces a $100K crypto loan service with DeFi integration Read

😲 Didn’t see that one coming

◾ CoStar reports nearly $2B in commercial properties damaged or destroyed by L.A. fires Read

◾ Merchant Cash Advance Company settles a $1B case with New York AG over predatory lending practices Read

◾ APF Properties defaults on a $155M loan for their 28 West 44th Street property Read

◾ Unnamed lender sues CA Ventures for loan default and outstanding balance Read

◾ Colliers faces second lawsuit from investors over alleged property fraud Read

◾ 174-year-old California bookstore chain files for bankruptcy Read

LENDERS, SEND US YOUR LOAN PROGRAMS AND CLOSED DEALS AND REACH OVER 3,500 INTERESTED READERS

Our newsletter is read by hundreds of finance professionals, executives, brokers, agents, investment bankers, CPAs, lenders, CEOs, CFOs, CRE Developers, Investors, lenders, and business owners worldwide.

We would love your feedback on what information you want more of. If you have anything interesting to share or a deal that we can help with, reach out to us by sending us an email at [email protected]. Thank you for reading, and enjoy the rest of your week.

Lastly, no content provided by Bridge Loan Guy or Loans, Lenders & Leverage should be considered tax, investing, or financial advice. This email and any other content we provide are for entertainment and education purposes only. We do not claim to provide tax, investment, financial, or other legal advice. Any content provided by Bridge Loan Guy or Loans, Lenders & Leverage is the personal opinion of our owners and/or staff – you should always conduct your own research.