- Loans, Lenders, and Leverage

- Posts

- RiseBoro, Terra, & Alloy Development Just Landed $987M Combined - Here's Why Lenders Are Breaking Their Own Rules

RiseBoro, Terra, & Alloy Development Just Landed $987M Combined - Here's Why Lenders Are Breaking Their Own Rules

[4 Minutes Read] Plus How Parking Lots Became the Hottest New Income Stream

Good Morning Everyone

Game-changing deals are reshaping CRE financing's DNA in last week’s $2B+ transactions, with RiseBoro's $412M mixed-use play revolutionizing through its "demographic cascade" model – think Jenga, where each piece removal strengthens the structure. Alloy Development's $290M green recapitalization proves sustainability drives better debt costs. At the same time, Terra's Miami Edgewater strategy brilliantly flips "concentration risk" into an advantage through micro-market saturation, making traditional diversification look outdated. In this new world order, being too concentrated isn't the risk – not being concentrated enough is.

Inside this week's top deals plus:

👥 How intentional demographic overlap just became lenders' favorite risk mitigant

🌱 Why ESG features are now driving better loan terms than location (yes, really!)

📍 How being "too concentrated" in one market became the hottest lending trend

🏢 The brilliant way operational synergies are unlocking lower debt costs

Let’s dive in.

🔄HELP SHARE OUR NEWSLETTER WITH YOUR FRIENDS AND NETWORK

I hope you find value in today’s newsletter if:

1) You want to know what active CRE lenders are mainly financing

2) You want innovative insights/strategies to secure CRE debt financing.

3) You seek active Commercial Real Estate lenders to close your next deal.

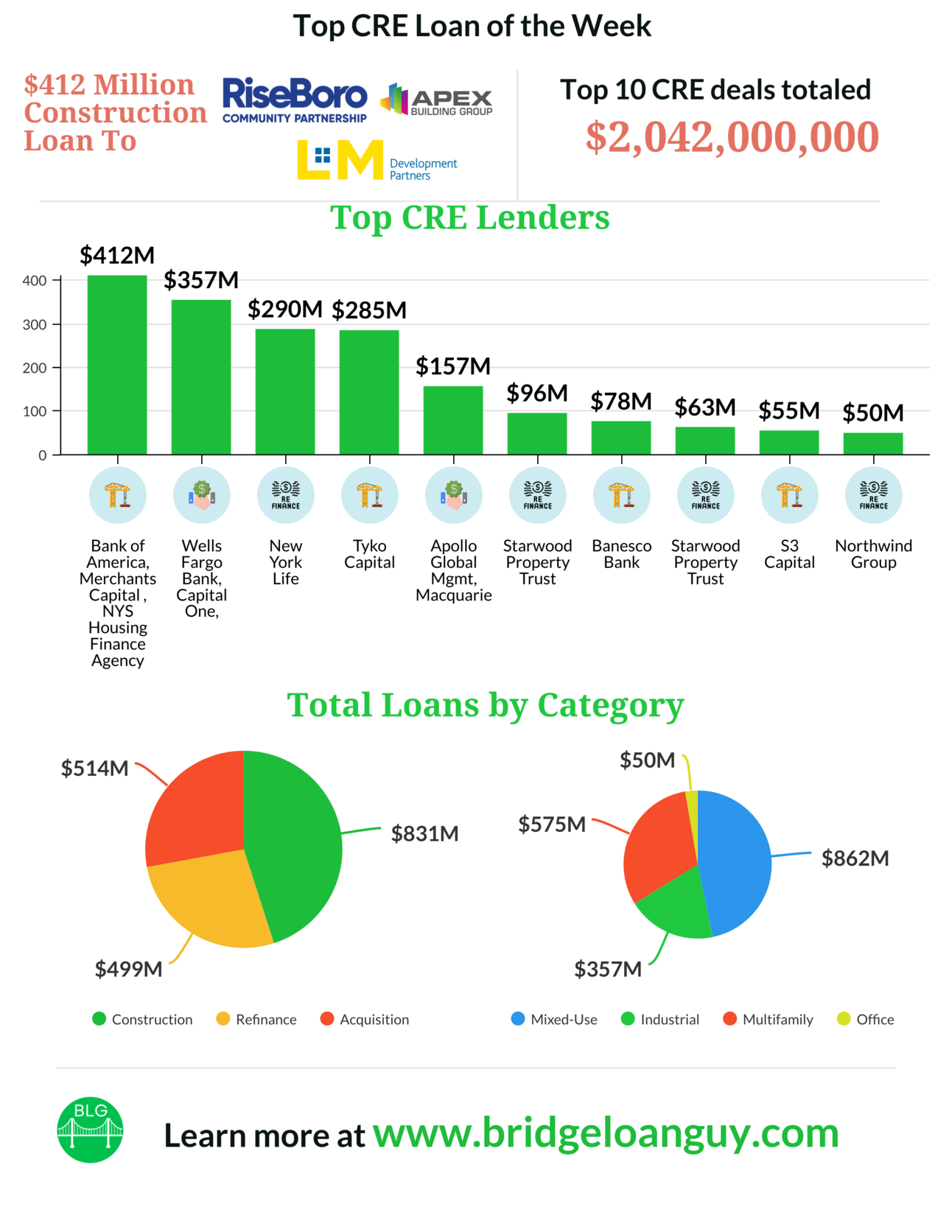

By the Numbers

Top CRE Lenders

Bank of America, Merchants Capital, New York State Housing Finance Agency, Wells Fargo, Capital One, New York Life, Tyko Capital, Apollo Global Management, Macquarie Group, Starwood Property Trust, Banesco Bank, S3 Capital, Northwind Group, Maxim Capital Group, ATC Managers, PACE Loan Group, Tryperion Holdings, Nuveen, and T-Max Lending.

Largest single deal: $412.4M (RiseBoro's Alafia development)

Number of states involved: 12

Sectors financed: Multifamily, Industrial, Mixed-Use, Office, Self-Storage, Production Studios, Affordable Housing

Construction Loans

◾ Titusville Developer: The builder lands $22M for 110 luxury apartments, with T-Max Lending betting on strong multifamily demand in Pennsylvania.

◾ Terra & One Thousand Group: The JV scores $285M to erect a Major Food Group-branded condo tower in Miami’s Edgewater, as Tyko Capital trusts in high-end presales.

◾ RiseBoro/L+M/Apex: They secure $412.4M to deliver 634 affordable units in Brooklyn, with Bank of America, Merchants Capital, and NYS HFA championing public-private synergy.

Refinancing Loans

◾ The Presidium Group: A $31M facility revives a historic Maine textile mill into condos, with Tryperion Holdings fueling adaptive reuse.

◾ GFP Real Estate: A $50M refi keeps 40 Exchange Place humming as Northwind Group stands by classic Manhattan offices.

◾ Alloy Development: A $290M recap ignites progress at The Alloy Block, with New York Life backing eco-savvy mixed-use in Downtown Brooklyn.

Acquisition Loans

◾ MDH Partners: A $357.8M war chest helps nab a 5.5M-square-foot industrial portfolio, with JLL’s Capital Markets fueling multi-state expansion.

◾ Kushner Companies: A $157M package closes on a waterfront tower in Miami’s Edgewater, as Apollo & Macquarie bet on Florida’s multifamily boom.

◾ ATC Managers: A $37M ticket locks down a 150-unit Queens portfolio, with a 9.5% fixed-rate loan reflecting the borough’s strong fundamentals.

Bridge Loans

◾ Neology Development Group: A $63.5M bridge gets a Miami Allapattah multifamily project over the finish line, Starwood Property Trust eyeing swift lease-ups.

◾ Sioni Group: A $96.1M lifeline refinances a fresh Bronx mixed-use asset, with Starwood bridging the gap toward stable occupancy.

Last Week’s Analysis

🏗️ The Demographic Cascade Strategy

RiseBoro's $412M mixed-use development financing demonstrates sophisticated demographic programming where different components (affordable housing, retail, community space) create intentional demographic overlaps. This "cascade" approach to demographic targeting represents an evolution in how lenders evaluate project stability through social infrastructure creation.

Strategy Tip: Design projects with intentional demographic interaction points, demonstrating how these intersections create sustainable community engagement and enhanced asset stability. Additionally, document how mixed-income projects and diverse retail tenants drive higher retention rates and consistent foot traffic to support rents.

Capital Sources: Community development financial institutions, Impact investors, Social infrastructure funds

🔄 Sustainability as a Leverage Tool

A fascinating pattern emerges from Alloy Development's $290M recapitalization for their all-electric residential tower, suggesting that sustainability features are evolving from cost centers to leverage enhancers. The deal's structure, combining traditional senior debt with specialized construction financing, indicates that lenders are beginning to price in future regulatory compliance value and reduced operational risk associated with sustainable buildings.

Strategy Tip: Quantify how sustainable features enhance debt service coverage ratios and reduce regulatory/operating costs, demonstrating clear risk reduction that lenders can underwrite today. Additionally, structure sustainable features to qualify for green financing.

Capital Sources: Insurance companies, Green bonds, ESG-focused debt funds

🎭 Mixed-Use as Risk Mitigation

Arabella's $96.1M refinancing by Starwood demonstrates how operational convergence between residential and retail components can enhance lending terms. Pre-leasing retail space to tenants with daily needs (Aldi, quick-service restaurants) created an operational hedge for the residential component, effectively lowering the project's blended risk profile. This represents an evolution in how lenders evaluate mixed-use risk.

Strategy Tip: Structure the retail tenant mix to create direct operational synergies with residential components. Then, demonstrate to lenders how these synergies enhance overall project stability.

Capital Sources: Real estate debt funds, Commercial banks, Life companies specializing in mixed-use

🌊 The Micro-Market Momentum Play

Terra's sequential project financing in Miami's Edgewater submarket (including the $285M Villa project) illuminates a sophisticated approach to submarket concentration. Rather than viewing multiple projects in one submarket as a concentration risk, lenders are beginning to recognize clustered development strategies' operational efficiencies and market intelligence advantages. This represents a paradigm shift in how geographic concentration is evaluated in construction lending.

Strategy Tip: Develop detailed micro-market intelligence platforms that demonstrate how multiple projects in one submarket create operational efficiencies and market advantages. Use metrics like cost savings and lease-up rates to demonstrate reduced risk to lenders.

Capital Sources: Market-specialist debt funds, Regional banks with strong submarket presence, Development-focused private equity firms

Meet the AI tool fighting against bias and censorship: Venice.ai

Break free from biased and censored AI. Venice uses leading open-source tech to deliver unrestricted machine intelligence, while preserving your privacy. Try it now for free, or upgrade to Pro with code BEEHIIV for 20% off.

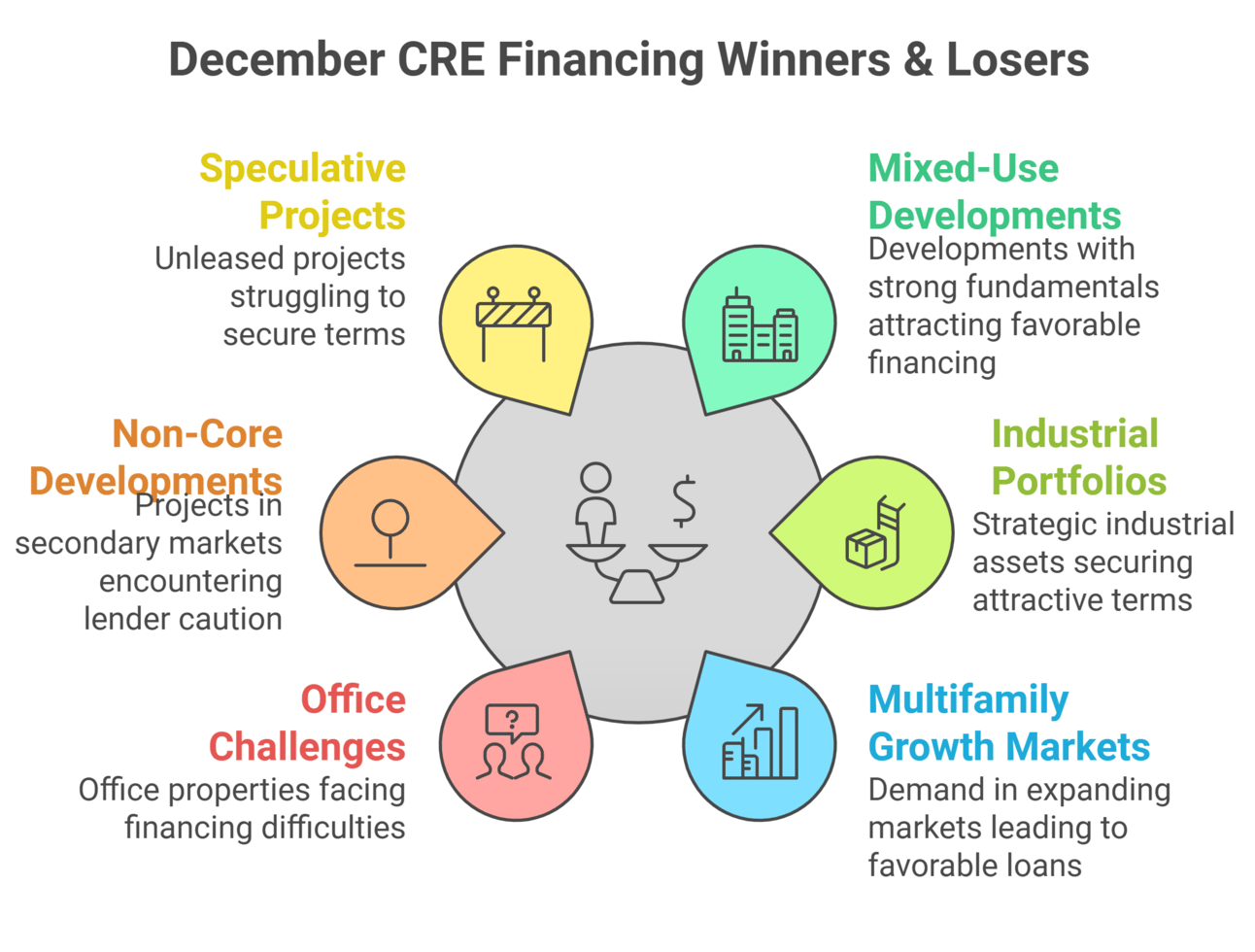

🏆 Winners

◾ Mixed-Use with Strong Fundamentals: The Alloy Block secured five-year fixed-rate financing from New York Life, while RiseBoro's Alafia project landed $412.4M from Bank of America, demonstrating lender confidence in quality mixed-use developments

◾ Industrial Portfolio Plays: The MDH F3 Arctic Portfolio and COFE Properties' Charleston portfolio secured attractive financing terms, showing strong lender appetite for industrial assets in strategic locations

◾ Multifamily in Growth Markets: ATC Managers landed a 6-year fixed-rate loan at 9.5% for their Queens portfolio, while The Estate Companies secured $78M for their Davie, FL development, highlighting the demand for multifamily in growing markets

❌ Losers

◾ Office Properties Without Clear Exit: 40 Exchange Place required specialized financing from Northwind Group, reflecting continued challenges in the office sector despite strong sponsorship

◾ Non-Core Market Developments: Projects in secondary locations faced higher rates and stricter terms, reflecting lender caution outside primary markets

◾ Speculative Development Without Pre-Leasing: Projects without significant pre-leasing faced challenges securing favorable terms, especially in retail and office sectors

📝 Current Tips For Borrowers

Rate Stack Optimization: Instead of focusing solely on headline interest rates, analyze the full capital stack opportunities. Consider innovative structures like C-PACE (seen in the Gateway Studios deal) as a complementary layer, not just an alternative.

Cross-Market Arbitrage Play: The success of multi-state industrial portfolios suggests bundling assets across different markets to create portfolio diversity that appeals to national lenders. This often secures better terms than financing individual assets separately.

ESG Premium Capture: Forward-thinking borrowers can secure 25-35 basis point reductions by incorporating verifiable ESG metrics, particularly for measurable efficiency improvements with life companies and GSE lenders.

Anchor Tenant Leverage Strategy: Sophisticated developers are securing longer-term tenant commitments (10+ years) with credit tenants, even at lower rents, as this dramatically improves debt terms and access to permanent financing.

Rescue Capital Premium: With $544 billion in CRE debt maturing in 2025, strategic borrowers are positioning as rescue capital providers, negotiating favorable assumption terms with lenders for troubled assets, especially in the office sector.

Operational Income Enhancement: Leading borrowers are incorporating auxiliary revenue streams like parking automation and solar leasing into their underwriting, gaining credit from lenders for these innovative income sources.

💡 Financing & Referral Opportunities for Brokers & Lenders

Location, Location, Location: New York City Metro-Area, Miami, Charleston, Chesterfield (MO), and Pennsylvania (Sub-Markets)

Referral Partners for Brokers:

◾ Entertainment industry consultants and production facility operators

◾ Solar panel installers, parking automation companies, and micro-fulfillment center operators

◾ Construction Project Managers, Property Tax Assessment Firms, and Zoning AttorneysFinancing Opportunities

◾ Entertainment infrastructure lending

◾ Projects that combine affordable housing with essential services

◾ Mixed-use developments anchored by life sciences tenants, especially those near medical centers or universities

😲 Didn’t see that one coming

◾ EY faces accusations of aiding a UAE firm in defrauding SPAC investors, spotlighting Big Four auditing standards Read

◾ The Container Store Group files for voluntary bankruptcy protection, citing a housing crisis and cash-flow challenges Read

◾ CFPB sues Zelle operator and major banks over "widespread fraud" on the payment network, rattling consumer trust Read

Lender of the Week: California CRE Bridge Lender

Time to Close: 14 – 21 Days (Owner-Occupied) 7- 10 days (Non-Owner)

Paperwork Required to Get LOI: Loan Application, Credit Report, Most recent tax returns, Most recent paystub, Most recent asset statements (Checking, saving, retirement, investment), Most recent Mortgage statement, Homeowners insurance, driver license

Min Loan: $250K

Max Loan: $10M

Sweet Spot: $1.5M to $4.5M

Minimum Credit: 680

Interest Rate: 9.5% to 10.5%

LTV: 75%

Origination Fee: 1.5 – 2.5 (Depending on LTV, location, and credit

DD, Appraisal & UW Fees: $1000 to $2000

Collateral/Asset: Just the property

Repayment Terms: All interest only – Monthly – 11 month terms for Owner-Occupied

Prepayment Penalties: None on owner-occupied. 3-6 months on Investment.

Extension Options: 3-6 months

Locations: Mainly CA. We have some exceptions

Are you looking to close your time-sensitive and important CRE, ABL, or GrowthCap deal?

⮞ Get direct introductions to top lenders that can help you close your time-sensitive deals

⮞ Reach out to [email protected]

ADVERTISE WITH US AND REACH OVER 3,500 SUBSCRIBERS

Our newsletter is read by hundreds of finance professionals, executives, brokers, agents, investment bankers, CPAs, lenders, CFOs, CRE Developers, Investors, lenders, and business owners worldwide.

We would love your feedback on what information you want more of. If you have anything interesting to share or a deal that we can help with, reach out to us by sending us an email at [email protected]. Thank you for reading, and enjoy the rest of your week.

Lastly, no content provided by Bridge Loan Guy or Loans, Lenders & Leverage should be considered tax, investing, or financial advice. This email and any other content we provide are for entertainment and education purposes only. We do not claim to provide tax, investment, financial, or other legal advice. Any content provided by Bridge Loan Guy or Loans, Lenders & Leverage is the personal opinion of our owners and/or staff – you should always conduct your own research.