- Loans, Lenders, and Leverage

- Posts

- Last Week's Unbelievable Deals: LBA Logistics $577M, Kennedy Wilson $184M, Allure Group $155M

Last Week's Unbelievable Deals: LBA Logistics $577M, Kennedy Wilson $184M, Allure Group $155M

[4 Minutes Read] Plus West Coast CRE Bridge Lender

Good Morning Everyone

Last week, the real estate finance market experienced a surge of activity fueled by a drop in interest rates. The Federal Reserve’s 50 basis point reduction enabled banks to reclaim around $30 billion in corporate debt deals from private credit funds, mainly through broadly syndicated loans. Research from Bank of America highlights that banks have orchestrated over 70 refinancing deals year-to-date, marking a significant comeback after years of losing ground to private credit. This resurgence, driven by companies seeking to lower borrowing costs, has spanned multifamily, industrial, life sciences, and senior housing sectors, with lenders offering a diverse array of financing structures to meet borrowers' evolving needs. Let’s dive into it.

📊 By the Numbers

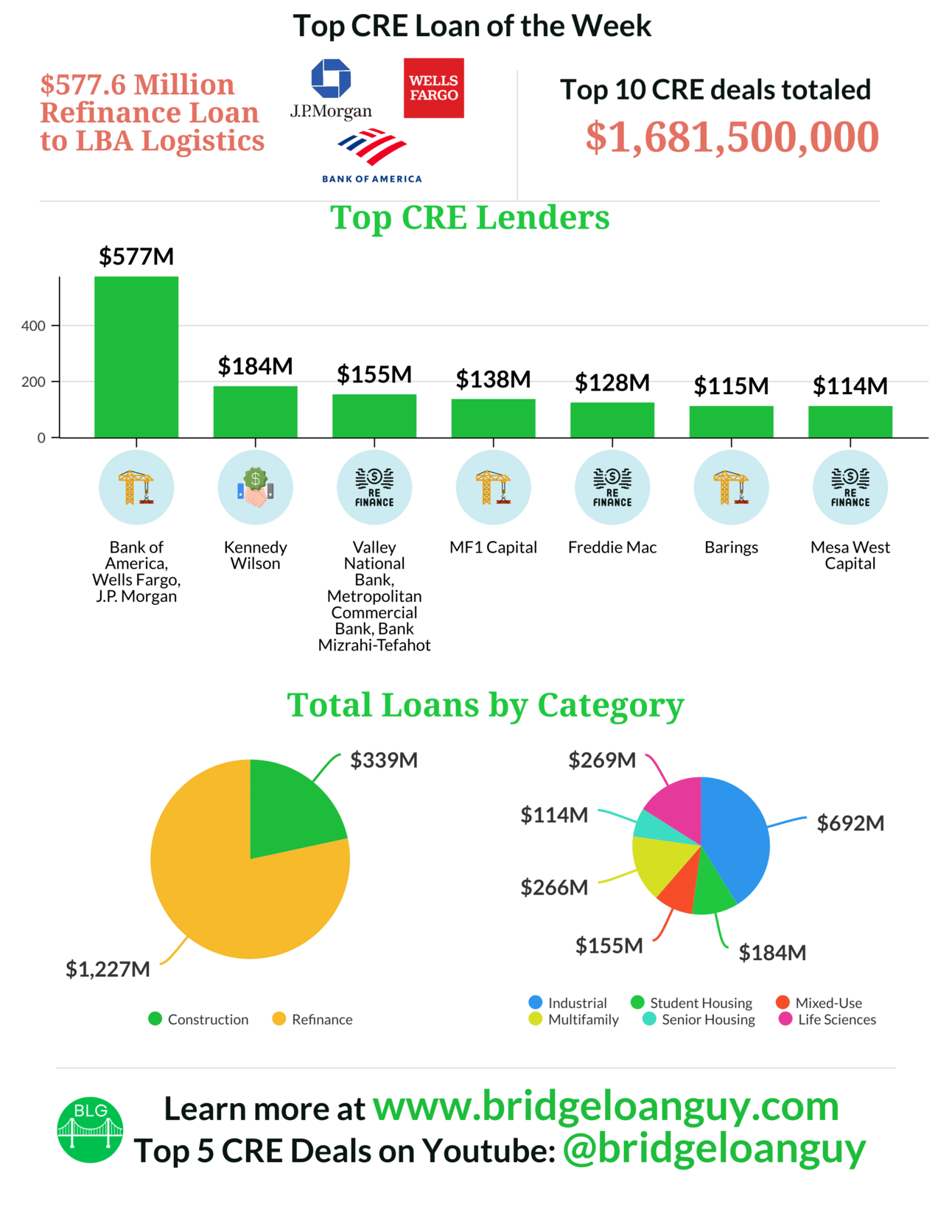

Top CRE Lenders

JP Morgan, Kennedy Wilson, Valley National Bank, Metropolitan Commercial Bank, Bank Mizrahi-Tefahot, MF1 Capital, Freddie Mac, Barings, Mesa West Capital, Société Générale, Sumitomo Mitsui Banking Corporation (SMBC), Union Labor Life Insurance Company (ULLICO), and Washington Capital Management.

Largest single deal: $577.6 million refi loan for LBA Logistics industrial portfolio

Number of states involved: 10+

Sectors financed: Multifamily, industrial, life sciences, senior housing, student housing, and office

Loan types and lenders

Floating-rate loans: Bank of America, Wells Fargo, J.P. Morgan (LBA Logistics deal), Mesa West Capital (AEW Capital Management senior housing deal)

Bridge loans: MF1 Capital (Carbon Companies multifamily deal)

HUD 223(f) loan: Bravo Capital (Buccini/Pollin Group multifamily deal)

Construction loans: Kennedy Wilson (student housing deal)

C-PACE financing: Nuveen Green Capital (Houston data center deal), Bayview PACE (Dallas office building deal)

Fixed-rate loans: Freddie Mac (ROI Capital multifamily refinancing deal)

🏆 Winners

Industrial developers, in particular, can capitalize on the favorable pricing environment. They should consider aggregating portfolios to attract similar SASB financing structures, potentially lowering their overall cost of capital.

Senior housing operators: are also in a prime position to benefit from the current financing landscape. These operators should consider refinancing existing properties or seeking acquisition financing to expand their portfolios.

Banks like Bank of America, Wells Fargo, and J.P. Morgan, which participated in the LBA Logistics deal, are well-positioned to capitalize on the strong demand for industrial financing.

Specialized lenders like Mesa West Capital, which provided the floating-rate debt for AEW's senior housing properties, can capitalize on the growing demand for senior housing financing.

❌ Losers

Office property owners face challenges, particularly those with assets in secondary markets or significant vacancy issues. To mitigate these challenges, they should focus on repositioning strategies to attract tenants and improve occupancy rates.

Retail property owners, especially those with traditional mall assets, may also find it more difficult to secure favorable financing terms. Therefore, they should consider redevelopment strategies incorporating experiential elements or exploring sale-leaseback arrangements.

CMBS lenders may also be disadvantaged in the current environment, particularly for large industrial deals increasingly going to SASB structures. CMBS lenders could explore ways to make their products more competitive for industrial assets, perhaps by offering more flexible prepayment terms or higher leverage options.

🔮 Tips For Borrowers

Consider SASB financing structures: for industrial assets, which can offer competitive pricing for large, high-quality portfolios.

Consider Floating-Rate Options: With several large floating-rate deals closing, lenders seem comfortable with these structures. They may offer more flexibility and potentially lower initial rates.

Explore Government-Backed Programs: HUD loans and other government programs can provide attractive terms, especially for multifamily projects.

Leverage Agency Relationships: Freddie Mac remains active in multifamily properties, offering competitive fixed-rate options.

Investigate C-PACE Financing: Lenders like Nuveen Green Capital and Bayview PACE provide this financing for energy-efficient improvements across various property types.

Be Prepared for Extra Scrutiny: Expect more stringent underwriting in challenged sectors like office or retail. Come prepared with strong market data and solid improvement plans.

💡 Financing & Referral Opportunities for Brokers & Lenders

Location, Location, Location: Dallas-Fort Worth, Frisco, Boston, San Diego, Washington D.C. and Philadelphia

Referral Opportunities/Partners: healthcare providers, medical equipment suppliers, specialized food service companies, biotech startups, pharmaceutical companies, specialized HVAC and waste management firms, trucking companies, logistics software providers, robotics firms specializing in warehouse automation, retail developers for shopping centers, fitness center chains expanding to these areas, and co-working space providers.

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

📈 Interest Rate Outlook

With the prevalence of floating-rate loans in recent deals, particularly from major banks, borrowers must monitor interest rate trends closely. Consider rate cap strategies or explore hybrid loan structures to mitigate potential interest rate risks while maintaining flexibility.

🦾 Addressing Challenges

The office sector faces headwinds, as evidenced by limited financing activity and increasing loan servicing issues. Bayview PACE's $3.5 million C-PACE financing for a Dallas office building underscores the need for property improvements to remain competitive. Office property owners should consider repositioning strategies and explore alternative financing options to enhance asset value.

⚖️ Regulatory Watch

Keep an eye on potential changes to government-backed loan programs, as these could significantly impact financing availability, especially in the multifamily sector. Any adjustments to programs like HUD 223(f) or Freddie Mac's lending criteria could alter the playing field for borrowers in this space.

Lender of the Week: West Coast CRE Bridge Lender

Time to Close: 2-3 weeks

Paperwork Required to Get LOI: Summary of the request (why do they need the loan),property description, Income & expense, rent role and PFS

Min Loan: $1 million

Max Loan: $35 million

Sweet Spot: $5 million - $10 million

Minimum Credit: 650 FICO

Interest Rate: 10.99% to 12.99%

LTV: 65%

Origination Fee: 2-3%

DD, Appraisal & UW Fees: Depend on cost of third party reports

Collateral/Asset: Office (Very Selective), Industrial Flex or Warehouse, Retail, Mobile Home Parks, Hospitality, Multifamily, Self-Storage

Repayment Terms: Monthly and always interest only, 2 years

Prepayment Penalties: Usually max 6 month yield maintenance

Extension Options: Yes but max 2 years on smaller loans and 3 on larger

Locations: Nationwide in suburban markets with 50K+ population

Refinancing Options: No

Are you looking to close your time-sensitive and important CRE, ABL, or GrowthCap deal?

⮞ Get direct introductions to top lenders that can help you close your time-sensitive deals

⮞ Reach out to [email protected]

😲 Didn’t see that one coming

ADVERTISE WITH US AND REACH OVER 6,650 SUBSCRIBERS

Our newsletter is read by hundreds of finance professionals, executives, brokers, agents, investment bankers, CPAs, lenders, and business owners worldwide.

🔄HELP SHARE OUR NEWSLETTER WITH YOUR FRIENDS AND NETWORK

If you found value in our newsletter today, please share it with your friends and colleagues. In return, we will enroll you in our monthly prize drawing for a two-day hotel accommodation or airfare for two to any 23 vacation destinations in the continental United States. Plus, you get a free entry for every subscriber who joins our newsletter using your unique link below.

We would love your feedback on what information you want more of. If you have anything interesting to share or a deal that we can help with, reach out to us by sending us an email at [email protected]. Thank you for reading, and enjoy the rest of your week.

Lastly, no content provided by Bridge Loan Guy or Loans, Lenders & Leverage should be considered tax, investing, or financial advice. This email and any other content we provide are for entertainment and education purposes only. We do not claim to provide tax, investment, financial, or other legal advice. Any content provided by Bridge Loan Guy or Loans, Lenders & Leverage is the personal opinion of our owners and/or staff – you should always conduct your own research.